Dear Clients,

For many investors, 2022 was a year to forget. The Russell 2000 was down 20.5%, the S&P 500 was down 18.1% and the NASDAQ Composite was down 32.5% for the year. These are their worst annual returns since 2008. The most popular cryptocurrency, Bitcoin, was down 64.3%. Even bonds did not provide a safe refuge, with the Bloomberg US Aggregate Bond Index down 13.0% for the year. It was the worst-ever annual return for that index, dating back to 1976. Given these market returns, we are pleased to report that our Separately Managed Account Composite was down 10.7% in 2022 (individual account performance may vary).

Our 9.8% outperformance against our benchmark (Russell 2000) in 2022 was smaller than our 16.9% outperformance in 2021 (+31.7% vs. +14.8 for Russell 2000). However, in many ways, the 2022 outperformance was more gratifying. Back in 2021, we believed certain pockets of the market were fraught with speculative risks and may soon experience great wealth destruction. We warned in our 4th quarter 2021 newsletter: “Speculation always ends badly; what the Fed is doing now is simply hastening its demise.” That turned out to be a good way to summarize the year 2022. Our primary objective in the last couple years was to insulate our clients from the potential storm, and we sought to avoid risky areas and invest in sound businesses. It may now seem like an obvious thing to have done, but yet it was not at the time. To position our portfolio properly, we had to resist pressure to go along with the crowd. When we criticized rampant speculation and explained our rationale for staying away, many would simply reply, “You just don’t get it.” In fact, what we did “get” was that a complete disregard for investing principles eventually leads to disasters. Fortunately, we have clients who understood our investment philosophy and allowed us to help safeguard their portfolios throughout this period. We want to again express our appreciation, and we will work every bit as hard going forward to be a good steward of your assets.

The year 2023 will bring a different set of risks and uncertainties, and we’ll touch upon how we’ve positioned our portfolio to handle them. But before we begin, let’s discuss a couple underappreciated, and yet important, observations about uncertainties.

First, the world is always uncertain. It seems like going into every new year, we would hear many proclaim that it is “an increasingly uncertain world.” But we often feel the world is not increasingly uncertain – it just is uncertain. There will always be surprises – what we need is an investment approach that can work reasonably well when the unexpected does happen. Who would’ve thought the year 2020 would bring us a pandemic, which would eventually force various societies to lock down, with severe economic consequences? We all feel a lot better now, but remember how scary it was at the time? And who could’ve predicted it? Then there was Russia’s invasion of Ukraine in 2022, which also caught the world off guard. Even when President Biden warned in early February 2022 that an invasion was imminent, most European leaders didn’t believe him. Then the surprise came when Russian tanks rolled in. There are many other examples throughout history that have taught us to never simply expect smooth sailing.

The inevitability of uncertainties is the reason why, in addition to cheap valuations, we emphasize strong balance sheets and competitive positions in our investments. You never know what could come out of left field. A conservative balance sheet may not seem important during good times, but it has tremendous value. It’s the same reason why a financially prudent individual would have savings or an emergency fund – it’s not just for the expected expenses, but just as importantly, for the unexpected ones. We always remind ourselves the absence of surprises is only possible in hindsight. The same will be true for 2023 and beyond.

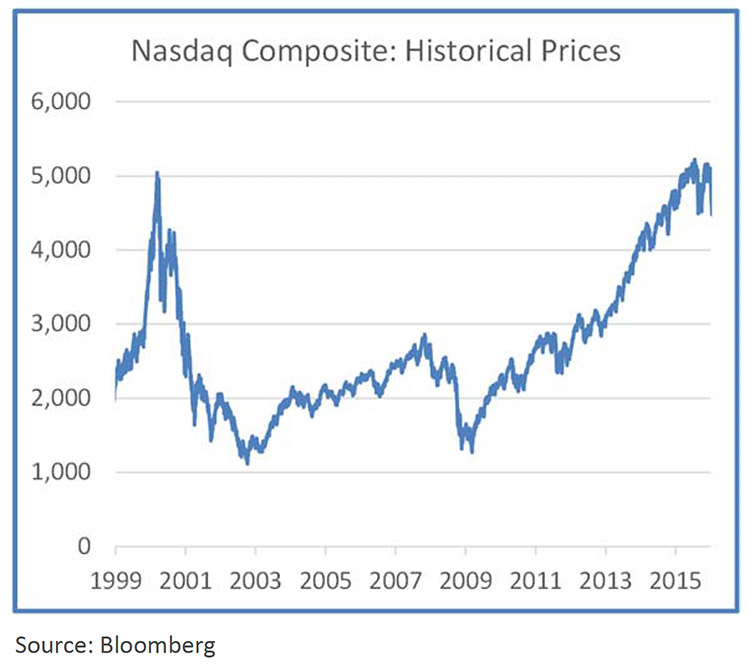

Second, investment risks can be very different from headline risks. In other words, investment risks are often different from what you read and worry about. Looking back, we can agree one of the biggest risks in the last year or two was the unreasonable, or even crazy, valuations in parts of the market. The NASDAQ Composite just lost 1/3 of its value in 2022, and some of the most well-known high-flyers lost much more: Tesla, Rivian Automotive, Carvana, AMC Entertainment, Coinbase, and ARK Innovation ETF were down anywhere between 65% and 98% in 2022 alone. It’s perhaps an understatement to say there were substantial risks associated with these investments. But where were the headlines warning us about them? If any, the headlines were more about how these stocks were hitting highs day after day, which only served to lure in more innocent investors. If history is any guide, these stocks likely won’t make a comeback in a hurry, if ever (the NASDAQ Composite took 15 years to recover from the dot-com bubble, as shown on the right). The speculators have been scarred and now have little appetite for a second act. Rest assured, however, at another time and under a different set of circumstances, a new cohort will emerge to take their place.

Going into 2023, the risks that investors are most concerned with include persistently high inflation, the Federal Reserve’s rate hikes and quantitative tightening, prospect of a recession, and geopolitics. Much of these concerns have been priced into stocks. These are issues that we had thought long and hard about, and our clients may be curious about how we’ve positioned our portfolio. First, in general, we believe stocks represent one of the best long-term investments (provided you don’t jump into parts of the market with irrational valuations). One reason is that stocks can handle inflation much better than cash and cash-denominated assets (i.e. bonds). To put it simply, if products and services go up in price over time (the definition of inflation), so should the price of the businesses that provide them, and stocks, as we all know, are pieces of a business.

Moreover, we invest mostly in small-cap stocks, and there are thousands to choose from. The abundance of them allows us to stay nimble. The truth is, regardless of what the world looks like, there will always be winners and losers. We try to identify, as best we can, those that will have tailwinds at their back. If we’re worried about inflation, can we find a company, for example, that provides responsible financing options to the low-income earners, who tend to be disproportionately hurt by inflation? If the world is suffering from supply chain issues, can we find a company whose true earnings power is being masked by these short-term challenges? If we think the economy would cool down from the over-stimulated levels, can we find businesses that provide essential products (such as broadband connections, electricity, medical applications, etc.), which are more immune to an economic downturn? These, by the way, are or were actual investments in our portfolio. Of course, it’s far from sufficient to simply identify these businesses – their stocks must also, in our assessment, trade at a significant discount to the value of future cash flows and assets. That’s where the hard work comes in. We have to be constantly on the lookout: reading, investigating, and interviewing industry participants. It’s not necessarily an easy process, but it’s a process we enjoy. We believe that investing in stocks, with an emphasis in small caps and a strict adherence to the value investing framework, allows us to better adapt to an ever-changing world.

Key Statistics

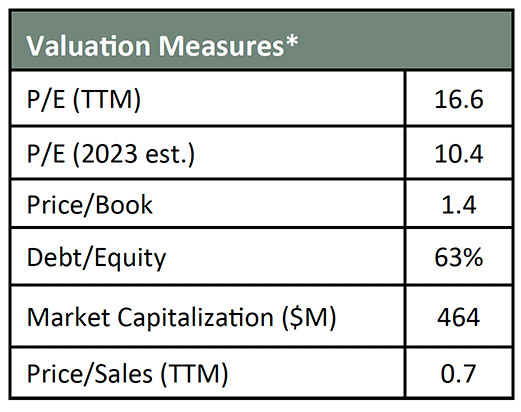

As of 12/31/2022, our top 30 positions traded at a discount to the major indices, with an estimated median P/E of 10.4 for 2023 versus higher estimated P/Es for the S&P 500 at 15.5, NASDAQ-100 at 17.8 and Russell 2000 at 16.6.

The chart below is an overview of key valuation measures of the Separately Managed Accounts

Composite as of 12/31/2022.

*Figures in the table above are median of the top 30 stocks of the aggregate portfolios on 12/31/2022 (individual portfolios may not have the same stocks or concentration). “P/E (TTM)” is price divided by the EPS for trailing twelve months. “P/E (2023 est.)” is price divided by 2023 earnings estimates. Source of estimates is Bloomberg or First Wilshire; some estimates are not available. All other figures are the latest available data at quarter‐end.

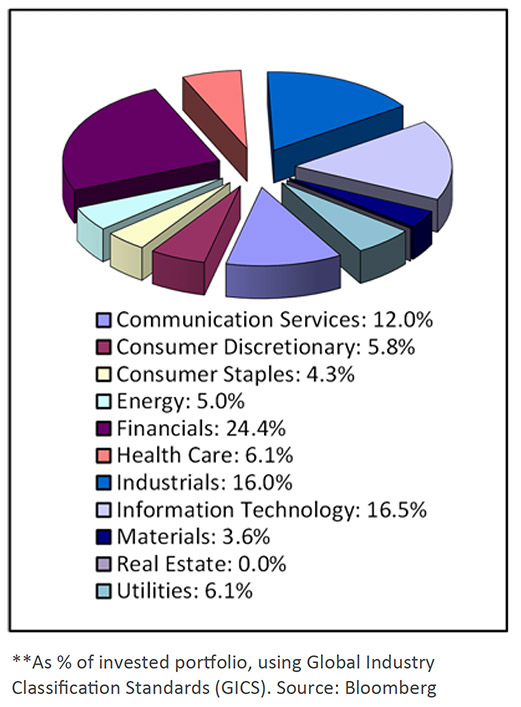

Sector Allocation

To practice our investment philosophy successfully, we must have a client base that subscribes to the same philosophy. That’s why we take all our communications (including the quarterly newsletters) very seriously. We must be clear about what we are and what we are not. From clients’ perspective, they have to understand a manager’s investment philosophy before entrusting the manager with their assets. From our perspective, we can’t consistently apply value investing through different market cycles if clients don’t believe in what we do.

Of course, it doesn’t mean we always see eye to eye in all facets, but we’re largely in sync. In the last couple years, for example, while clients may have inquired about crypto-related or other overhyped stocks, none insisted on us buying them on their behalf. Having the same core beliefs has been crucial in developing our long-term partnerships.

In November, Scott, Howard, Nicole and Esther traveled to the Boston area. We were very happy to finally have the chance to meet face to face again with so many clients and prospects. During our presentation, we updated our clients on our team, reviewed the history of the stock market during major events, explained the impact of higher interest rates, and discussed the valuations of our portfolio. We’ve known most of our clients in Boston and Cape Cod for many years (the longest relationship started 36 years ago, when Ronald Reagan was the president). Although our profession is investing and research, it also has a big personal element to it. Nothing is more gratifying to us than seeing a portfolio grow for the people we’ve known for so long. If you have any additional questions about investing or personal finance, feel free to reach out to us any time. We have decades of investment experience, and four members of our research team are both Chartered Financial Analyst® and CERTIFIED FINANCIAL PLANNERTM professionals.

Thank you for your continuing trust.

First Wilshire On The Road

Annual meeting of JG Boswell, a 90-year-old agriculture company. It owns 150,000 acres of land in the San Joaquin Valley of California and grows primarily cotton, tomatoes, and pistachios. It used to own a large Australian farming operation but sold it for near $300 million in 2021, which turned out to be very good timing. If you are interested in their storied past, google “JG Boswell” to learn about the founder. Because its voting shares are controlled by the founders’ family and foundation, the company does very little to cater to outside shareholders. It does not report its operations and finances to the level of details that other publicly-listed companies typically do. Therefore, attending the annual meeting is one of the few ways to further understand the company. But even getting into the meeting is difficult: You must own shares of the company and prove your ownership beforehand in order to be admitted. Overall, it is an interesting stock because it trades at a significant discount to the value of the land it owns. However, realizing this value can potentially take a long time.

From the left, Howard, Esther, Nicole and Scott after a client lunch on Commonwealth Avenue in Boston. Our trip had a rough start: In the early morning of our flight departures, there was heavy rain in Los Angeles, causing major traffic delays to the airport. Esther unfortunately got into a minor car accident as a result. But somehow we managed to arrive in Boston on schedule. It was great to see our clients again in person after a few years of hiatus. In addition to answering any questions our clients had, we found it fun and fascinating to hear our clients’ stories. Nicole grew up in the Boston area, so the trip had the added benefit of returning home. For the rest of us, we enjoyed the city for its beauty and history. We look forward to our next trip back.

A Message from Client Services

Happy New Year!

We hope all of you had a nice holiday season. We were so excited to have resumed in-person events, like the ones we just had in Boston and Plymouth in November. Now we are planning to host our Southern California clients for lunch and wine tasting on Saturday, February 25th, at San Antonio Winery in downtown Los Angeles. If you have plans to be in the area and would like to join us, please let us know! You may contact Client Services at clientservices@firstwilshire.com

or call us at 626-796-6622.

First Wilshire Securities Management, Inc. (“First Wilshire”) is an independent investment adviser registered with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. First Wilshire claims compliance with the Global Investment Performance Standards (GIPS®). GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. First Wilshire’s compliance with the GIPS® standards has been verified for the period from 12/31/1996 to 3/31/2017 by Ashland Partners & Company LLP and from 4/1/2017 to 12/31/2021 by ACA Performance Services, LLC. In addition, a performance examination was conducted on the Separately Managed Accounts Composite beginning 12/31/1986. A copy of the verification report is available upon request. First Wilshire’s Separately Managed Accounts Composite performance data represents a composite of all fully discretionary accounts with comparable investment objectives and risks, managed by First Wilshire beginning 12/31/1986. This composite typically, but not exclusively, invests in small capitalization, U.S.-listed stocks. The benchmark is the Russell 2000® Index, which is a market cap-weighted index and measures the performance of the small-cap segment of the U.S equity universe. It is a subset of the Russell 3000® Index and includes approximately 2,000 of the smallest securities. The firm maintains a complete list and description of composites and a compliant presentation, which are available upon request (please contact Client Services at 626-796-6622). The U.S. Dollar is the currency used to express performance. The information, data, strategies, and opinions included in this report are subject to change without notice based on market and other developments. First Wilshire may have sold any of the above securities since this publication. This report is for informational purposes and does not represent an offer or recommendation to buy or sell a particular security. Past performances of stock markets, as well as those of First Wilshire client portfolios or any individual securities, are not indicative of future results. Investments, including First Wilshire separately managed accounts, offer the possibility of loss. Smaller capitalization equities are often considered riskier than larger capitalization equities due to, among other factors, lower trading volume and less financial resources. A thorough review of Form ADV Part 2A is required before making any investment decision. Results are time-weighted from inception and vary among accounts. There can be no assurance that any client’s investment objective will be achieved or that a client will not lose a portion or all of its investment account. The investment return and principal value of any investment will fluctuate over time. All investments carry a certain degree of risk, and it is important to review investment objectives, risk tolerance, tax objectives, and liquidity needs before choosing an investment strategy. Diversification through asset allocation does not ensure a profit or protect against loss.