The concept of socially conscious investing, known as ESG (for Environmental, Social, and Governance investment criteria) has been around a long time but has picked up steam in recent years. One of your portfolio managers did his senior project in college under the guidance of one of the early professors in the ESG area, who was actively advancing ESG research as well as putting it into practice as an advisor to a pension plan. This was a few decades before the investment industry began their slick marketing for well-intentioned dollars. According to a study by the Harvard Business Review, ESG investments have increased from $3 trillion in 2010 to $12 trillion in early 2018, representing 25% of U.S. stock fund investing market.

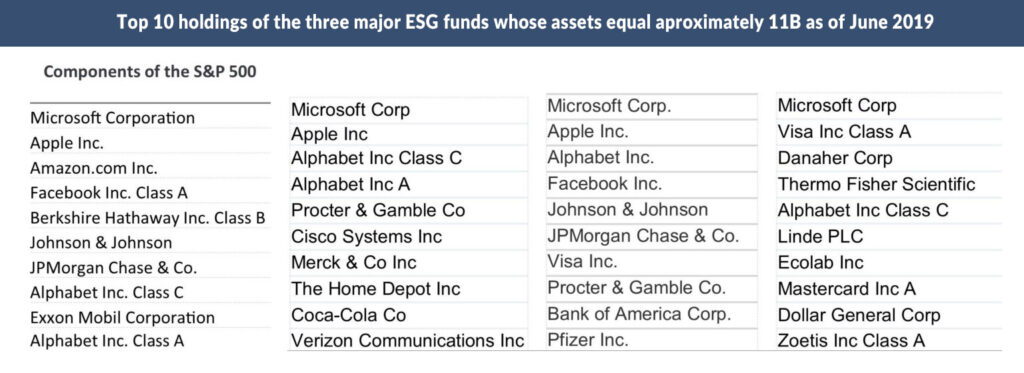

There can be many benefits to ESG focused investing but it is far from perfect. It certainly pressures companies to consider all of their stakeholders more, improving the lives of their employees, communities and the environment. Investors are hoping to invest and grow their savings while helping make the world a better place, a virtuous endeavor. However, many currently touted ESG investment choices seem to be created more to fulfill strong demand from these well-intentioned investors and drive investment firm profitability, subverting the ultimate goal to make the world a better place. One difficulty is defining what the ESG criteria should be and how strictly to apply them. From a review of the holdings in many of these ESG funds the criteria seems far too lax, if not ridiculous.

Shockingly High ESG Scores

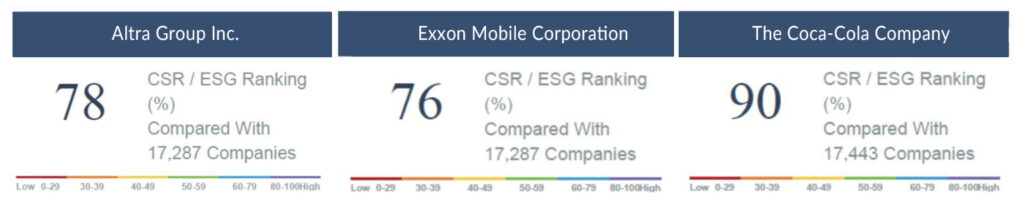

In the effort to institutionalize the ESG area, rating services have emerged to provide a score to public companies. They do very little of what we consider research, instead seeking low cost simplicity to keep up with the demand. Investment managers simply take these scores and build a portfolio that is surprisingly, if not offensively, identical to the market index. They can do this with almost no effort, investing billions of ESG themed dollars in minutes.

What a great business model! It may be shocking to discover that the ratings are not based on real hands-on research of the companies or, worse, the industry the company operates in is not even being considered. Meaning, companies like Phillip Morris (Altria), Chevron, CVS, and Exxon can manage their public relations to produce very high ESG scores, which they in fact have. They are so good at it that they score higher than almost every one of our portfolio companies. For example, our portfolio contains companies involved in providing clean water solutions, recycling and community focused banking services but don’t have the resources to fabricate high ESG scores. They therefore have lower ESG scores and are excluded from ESG funds.

Major ESG Funds Differ Little from the Market

9Source: S&P 500, TIAA-CREF Social Choice, Vanguart Social Index Fund, Calvert Equity Fund

First Wilshire makes it our business to know as much as we can about the companies we own and research, so we did some digging into the world of ESG. We produced a list of hundreds of the largest public companies as well as our entire portfolio to see what the rating services were assigning in numerical ESG scores. When our senior analysts heard the names of the top companies, rated an enviable 85 and above (scale of 1-100), they thought surely we were misreading the scores. They insisted the higher number must mean the inverse, low numbers were positive and high numbers were negative. Sadly, this was not the case.

When one thinks of companies that should rate high on this type of scale they expect companies, at the very least, that cause little harm and hopefully produce something useful while treating their employees well. Fossil fuels, opioid sellers and tobacco typically don’t come to mind. One of our staff was dismayed a couple of years ago when looking at the top holdings of an ESG fund she was invested in. She found a fast food chain, which at the time was making the news for not paying thousands of employees overtime pay. Not only would ingesting their products arguably lead to poor health and their supply chain be the subject of exposés, but their poor labor practices were in the national spotlight. Despite this, it showed up as one of the top holdings for one of the largest ESG funds at the time.

We are not an ESG investment company and our primary focus is on maximizing our client’s returns while minimizing risk. However, we believe running a good business will help lead to higher performance and stock prices with less risk from negative events and that running a bad business can do the opposite. Performance can be improved by excluding companies that are cutting corners on environmental issues, treating employees poorly, or otherwise burdening the communities they operate in and serve. These factors are sadly often ignored by investors when valuing a stock until they are brought to light due to an environmental accident, regulatory action, or bad publicity from poor treatment of workers or customers. Looking back, it turns out these offending companies were falsely exhibiting stronger profits and being rewarded by the stock market because their true costs were not being accounted for. By removing these companies from a portfolio, performance can be improved and, by default, an ESG friendly portfolio begins to emerge.