It’s truly ironic that the stock market is very likely higher now than it would’ve been if no pandemic had taken place in 2020. The economy has been boosted by continuing vaccination efforts, aggressive monetary policies by the Federal Reserve, and the strong fiscal response by the federal government, but still, this is an outcome that even the most optimistic prognosticators couldn’t have foreseen at the beginning of 2020.

As the vaccines put us on a path to recovery, the government has continued to pump an incredible amount of money into the economy, with potentially more to come. The aggregate long-term effects, however, remain to be seen.

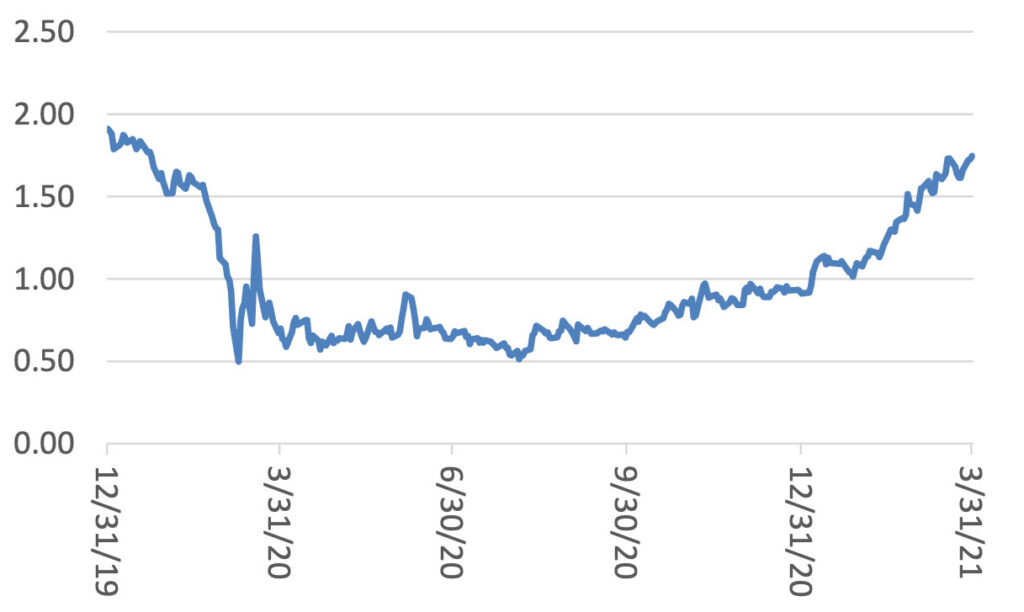

One effect that’s already abundantly clear is the reaction of the bond market. The U.S. 10-Year Treasury yield has quickly risen to 1.6% recently from the lows of around 0.5% in 2020. The borrowing costs are still quite low compared to historical levels, but we must carefully consider factors such as interest rates and price levels (inflation), and how they might affect our current and future portfolio companies.