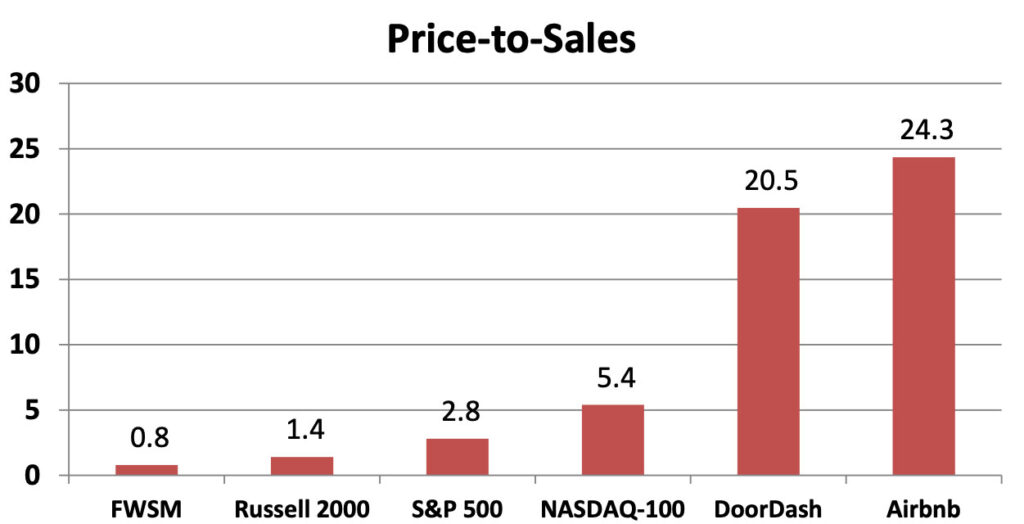

The more investors are obsessed with pie in the sky, the more they ignore gems at hand. We understood this 20 years ago as we bought into very-low-P/E stocks during the dot-com bubble, and eventually the discipline and patience paid off handsomely. We believe the same strategy can be applied in this market cycle. This chart helps quantify the valuation gap between the overall First Wilshire portfolio and popular indices and two companies that recently IPO’d.

We used price-to-sales ratio this time, rather than P/E, because Russell 2000, DoorDash and Airbnb don’t have positive earnings. In order to justify their valuations, DoorDash and Airbnb will have to continue growing their sales aggressively and turn their profit margins from negative to hugely positive, both of which are far from assured.

It’s also important to remember that the stocks we invest in are companies, employing hundreds or thousands of people, who in turn support many more people in their households. Companies in our portfolio employ approximately 600,000 people in total. They perform critical functions, such as providing loans to consumers and small businesses, offering broadband access to homes, restoring water systems, growing crops, making construction equipment, etc. They may not seem as sexy as tech companies, but they are critical to our lives. After all, we can’t survive solely on dog memes.