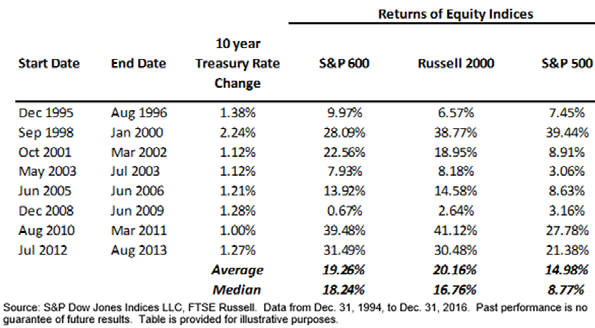

So how do stock markets, and in particular small caps, perform

during rising rate cycles? The table below, produced by Standard

& Poor’s (S&P), shows small stocks (the S&P 600 and Russell

2000) have tended to outperform larger stocks (S&P 500) when

interest rates rise. Rising interest rates do not automatically

spell doom for stocks.

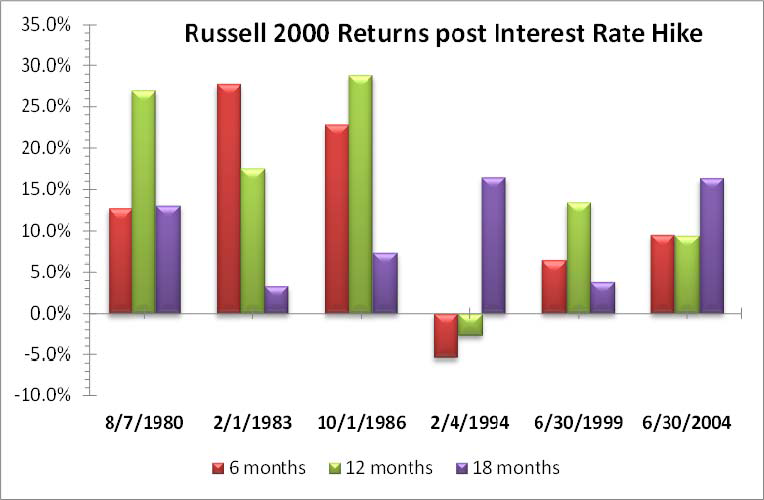

Inspired by the S&P study, we conducted our own historical analysis of how the Russell 2000, our small cap benchmark,

performed after rate hikes. We did a study looking back at times when the Federal Reserve started to raise rates and their resulting effect on small cap equities performance. Although “this time may be different” and there are many other contributing factors, this data gives investors some historical context about the relationship between rate increases and future market returns. The previous six times the Fed embarked on a tightening cycle and the associated small cap returns are seen in the graphic.