Dear Clients,

The second quarter was tough for most investors. Our benchmark, the small-cap Russell 2000 Index, was down 17.2%. The large caps didn’t fare any better: The S&P 500 was down 16.1% while the tech-heavy NASDAQ Composite was down 22.3%. Bitcoin, the most well-known cryptocurrency, was down a whopping 59.1%. Against this backdrop, we are pleased to report that our Separately Managed Account Composite was down 3.6% in the quarter (individual account performance may vary). Protecting our clients’ assets in this speculative environment in recent years has been our primary goal, and we’re happy to have achieved some success.

Of course, a quarter doesn’t make a trend, and we certainly understand that. But our Separately Managed Account Composite also outperformed Russell 2000 by 16.9% in 2021 (and by 10.7% in the first half of 2022). Therefore, we believe we have properly positioned our portfolio amidst a very speculative market. In this newsletter, we’ll try to explain how this outperformance was achieved, as well as correcting some common misconceptions about our investing style. We will also explain why, as the mood of the market has now become distinctly sour, we are more optimistic than ever.

The first principle that has contributed to our success is a strict adherence to value investing. The way we define “value investing” is simply buying an asset worth a lot more than the price we pay. It sounds so simple that it doesn’t seem to warrant any discussion. And yet, in the last couple years, a large part of the investing public had practiced the exact opposite, or the so-called “Greater Fool Theory.” In this fantasy world, the price that you pay for an asset doesn’t matter: The strong momentum will soon propel the price even higher, allowing you to sell to someone else for a quick profit. The participants, indulged by the recent success, paid no attention to the danger lurking underneath such an approach. We warned in our newsletter in the 4th quarter of 2020: “Speculators don’t have the reputation of sticking around. What motivates them is the recent price action. When prices go in reverse, they may get out just as quickly. What’s left is just high altitude and lots of air below.” The breathtaking declines in the high-flying stocks and cryptocurrencies in the 2nd quarter have made this danger amply and painfully clear.

There is always noise that tempts investors to do something unintelligent with their money. In 2021, the noise was louder than we’ve ever experienced. One particular commentary by a very well-known money manager epitomized this crazy period. In late 2021, this manager claimed that the institutional investors were moving into bitcoin and “could add $500,000 to bitcoin’s price.” Because bitcoin had been on an ascent (trading at roughly $50,000 at the time), few seemed bothered by this comment, and some might have even bought more bitcoin as a result. But let’s examine just how outrageous this comment was. Some may call us biased, but we have always thought cryptocurrencies were more or less “made-up” investments (First Wilshire Coin, anyone? It wouldn’t be any more ridiculous than dogecoin). The idea that these cryptocurrencies should supplant the real currencies and somehow governments would just let it happen seemed absurd. But let’s ignore that regulatory risk for a moment and examine the math behind this commentary. In late 2021, the market capitalization of all the cryptocurrencies combined was almost $3 trillion. What does $3 trillion buy you? Well, you could buy the entire Russell 2000. Yes, the roughly 2,000 small-cap companies currently fetch just $2.7 trillion. And if bitcoin should go to $550,000 as proclaimed, then all the cryptocurrencies could be worth over $30 trillion. Now with that money, you can buy the entire S&P 500: Apple, Microsoft, Google, Amazon and 496 other large companies in the U.S. Would anyone in their right mind (or anywhere close to it) trade these 500 businesses for some “currencies” created out of thin air? Yet, the way to justify a fantasy is to create more fantasies. This money manager prophesied with a straight face, to an audience that had largely forgone the right to think for themselves.

Throughout this craziness, we sought to never deviate from value investing. Our job is to safeguard and grow our clients’ assets, rather than try to “keep up with the times.” In our communications with our clients, we have insisted that investors are better served by stocks with strong business fundamentals and reasonable valuations. We repeated this message so much that some clients grew tired of hearing it (and perhaps we were even tired of saying it). But we understand that our clients have investments outside of First Wilshire and could fall victim to the traps that had become commonplace. When we received inquiries about speculative stocks and cryptocurrencies, we had to strongly express our opinion. Of course, we won’t always be right, but at least our opinion will be a product of careful analysis.

We’d like to correct a common misconception of what value investing is (at least to us). The investment world likes to categorize an investor as either a growth investor or a value investor. We always hear “growth vs. value”, as if to say if you’re a value investor, you don’t care about growth. Nothing can be further from the truth. Growth is one of the most important considerations in all of our investment decisions. Why wouldn’t it be? How much a business is worth is largely determined by what it can grow to. What we don’t do is buy into growth companies that have little chance of achieving consistent profitability or pay too much for growth. Now as the NASDAQ Composite trades at roughly 30% discount from the high reached in late 2021, don’t be surprised to see more information technology-related stocks in our portfolio. Keep in mind the 30% drop is for the tech space as a whole – some stocks have got hit much, much worse and can now be very interesting opportunities.

The second principle we hold dear is conservatism. Some of that conservatism is expressed through value investing: When you buy a stock at a discount to fair value, you have more downside protection, thus conservatism. It’s harder for a stock with a reasonable price-to-earnings ratio to go down 75% like Netflix did. Another important way in which we’re conservative is our aversion to leverage (“leverage” in finance just means using borrowed money for investing). If one were to examine some of the most spectacular blowups of funds in history – from Long-Term Capital Management in 1998 to the more recent Archegos Capital Management and Three Arrows Capital – the common thread is the use of high leverage. Debt works wonderfully until it doesn’t – it’s a tempting and dangerous instrument. And if you invest that borrowed money into risky assets, you have the perfect recipe for a complete disaster. It didn’t surprise us to see a fund like Three Arrows Capital, which used borrowed money to invest in cryptocurrencies, implode (and we’re afraid more funds will follow suit). These managers employ a “hero or zero” approach: If they get lucky and make a lot of money, they’re heroes. If not, they go to zero (with their clients’ money), and they retire and resurface years later and blame it all on bad luck.

First Wilshire doesn’t use leverage in our portfolio, and in addition, the companies we invest in have little leverage (or only leverage we deem to be safe). We don’t believe one needs to take on more risk in order to achieve higher returns. There are simply other ways to do it. We minimize the use of leverage even in our two hedge funds, although it’s very acceptable or even expected to employ leverage in the hedge fund industry.

There is sometimes a misconception that small-cap investing, by its nature, is not conservative. We strongly disagree with that generalization. We believe conservatism can very much be achieved in small-cap investing, and we hope our recent performance amidst the market sell-off provided some proof. The size of a company is only one factor in judging risks. Other more important considerations include industry dynamics, competitiveness of product offerings, balance sheet strength, management, and very importantly, stock valuation. Large companies can also lose competitiveness, take on too much debt, do bad acquisitions, be overvalued, etc. For example, PayPal, once valued at more than $300 billion, lost 77% of its valuation in less than a year. The investment industry has a tendency of oversimplification and stereotypes – growth vs. value, large vs. small, etc. – when the realities are much more nuanced.

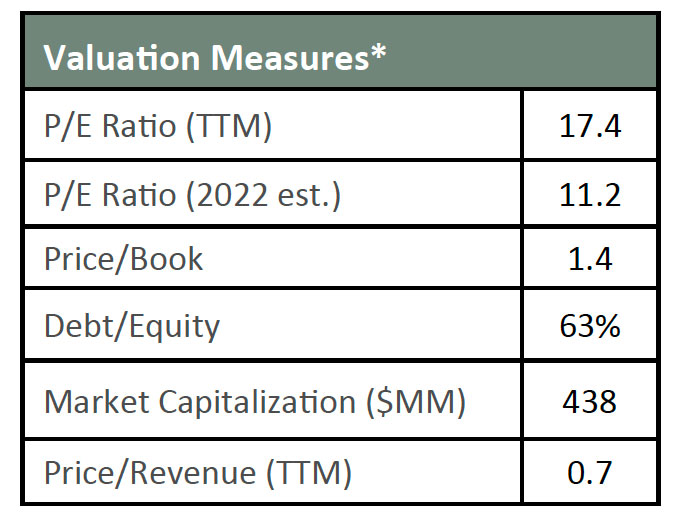

Key Statistics

As of 6/30/2022, our top 30 positions traded at a discount to the major indices, with an estimated median P/E of 11.2 for 2022 versus higher estimated P/Es for the S&P 500 at 16.5, NASDAQ-100 at 20.5 and Russell 2000 at 19.7. The chart below is an overview of key valuation measures of the Separately Managed Accounts Composite as of 6/30/2022.

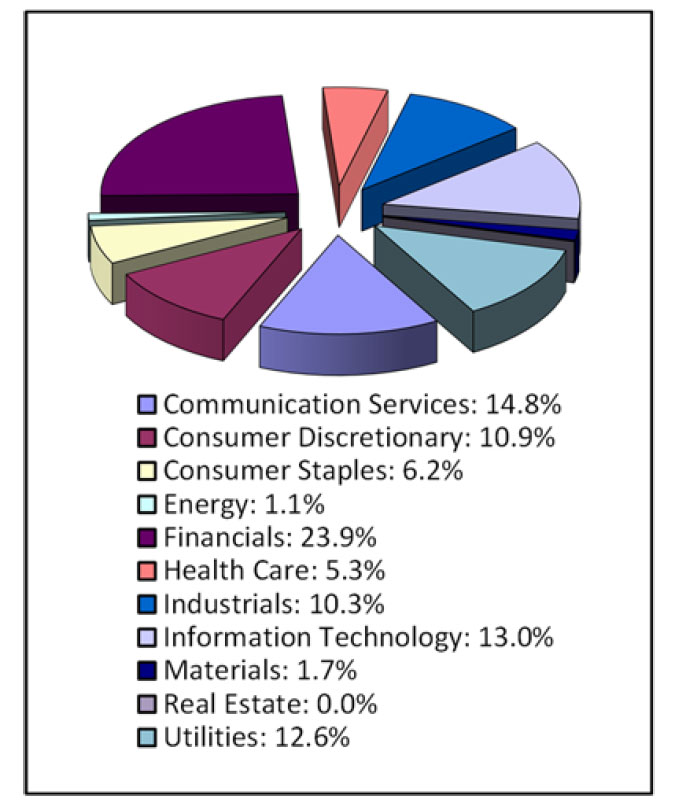

Sector Allocation

**As % of invested portfolio, using Global Industry Classification Standards. (GICS). Source: Bloomberg

Our third principle is that hard work is required in order to take advantage of the big opportunity set presented in the small-cap space. There are thousands of small companies traded in the United States alone. What makes our job interesting is that we get to comb through these companies and find some enticing bargains, in the hope that some of them will grow to be much bigger (the joy is only second to seeing your own kids grow up). At the same time, this large number of companies presents a challenge: How do we effectively go through these companies and learn their stories? We believe it comes down to three things: technology, process, and people. Over the years, we have worked hard to improve our technology in order to achieve extraordinary efficiency. We have tools that can download, in a matter of seconds, hundreds of business stats on almost any publicly-traded stock in the world. The data are in turn presented in an easy-to-digest format to our research team for speedy analysis. This is only one of the many tools we’ve sought to perfect over the years. We have also finetuned our research process over time – which investment conferences offer the most opportunities, which management are the best to talk to, how to best collaborate amongst ourselves, etc. Finally, our investment team has on average 20 years of experience in small-cap investing – and we’re only getting started.

As the stock market sold off, we are seeing more bargains. Recently, we found a company that we believe to trade at 70% of our estimated fair value. That’s a reasonable discount. Six months ago, we would’ve probably bought it. But this time, we decided to pass – because we believe there are even better bargains out there. It’s never a good feeling to let an opportunity go after doing a lot of due diligence, but we hope the next one will be even sweeter.

Of course this is not to say whatever we buy today will go up next month or even next year. We don’t know where the stock market will go in the short term. Pundits give their opinions on whether there will be a recession, how long inflation will last, or how the war in Ukraine will turn out, but these opinions have a high likelihood of being wrong. What can also affect the market significantly is the unforeseen events. If we look back just in the last two and half years alone, the major events that drove the stock market include the Covid-19 pandemic, the government’s subsequent ultra-easy money policies, and the war in Ukraine. Were any of them really foreseeable? Therefore, we don’t engage in predicting short-term market movements. What we do know is this: If you’re investing for the long term, you will certainly have highs and lows along the way, which tend to correspond to the mood of the market. Wouldn’t you rather buy at the lows, when the mood is sour, depressed, or even panicked? To invest when others don’t want to is a difficult concept to grasp, let alone practice. But we believe it’s the right thing to do, and we hope the three principles we’ve laid out will lead to satisfactory results in the long run.

Thank you for your continuing trust.

Sincerely,

First Wilshire Securites Management, Inc.

First Wilshire “On the Road”

Bill Caton, one of your portfolio managers, met with the CEO of a global industrial company (on the right). Originally a British company founded in 1898, it currently manufactures products such as high-pressure composite cylinders (to store hydrogen or compressed natural gas) and magnesium alloys (for critical aerospace and healthcare applications). A simple example of their products is breathing apparatus for firefighters, divers and healthcare workers. The company owns 10 plants in 3 countries. First Wilshire first met with the company in 2013, but it has since improved its operations while trading at a lower valuation. It is common for us to watch a company for many years, waiting for the right opportunity to buy in. We believe the company will begin to accelerate growth and achieve higher profit margins. This type of company checks many boxes First Wilshire looks for in an investment, namely strong balance sheet, unique competitive position within the industry, and strong management team with a credible plan to grow the business and generate strong cash flows. It should be worth the wait.

Scott Hood, another portfolio manager, toured the headquarters and packing facility of the largest avocado company in the world. The company was founded in 1983 by the current CEO (on the left), who spent almost five hours walking us through every aspect of the operations. Starting from a small packing facility in Oxnard, California, it now owns packing, ripening, distribution facilities throughout the world and sells into dozens of countries. The company recently added the capability of processing fruit (such as mangoes and blueberries), which could utilize their plants in the avocado off-season. Avocados primarily come from Michoacán, Mexico, but are beginning to grow in other parts of Mexico and Peru. Avocado prices spiked up this year, mainly because the U.S. government suspended all Mexican imports (after a U.S. plant safety inspector in Mexico received a threat just before the Super Bowl weekend). The CEO was an impressive blend of our favorite characteristics: entrepreneurial, highly motivated, scrappy, thrifty and a large shareholder. It is much rarer these days to meet a CEO who knows so much about their industry and company down to the smallest details.

A Message from Client Services

First Wilshire would like to thank you for being great clients and having the discipline to ride the highs and lows of the market. We mean this sincerely. You are more than just clients, but family. We have gotten to know about your children, grandchildren, pets, vacations, home repairs, weddings, new cars, art collections, etc. These relationships were developed over the years, and we appreciate the trust you have placed in First Wilshire.

“Appreciation can make a day, even change a life. Your willingness to put it into words is all that is necessary.” – Margaret Cousins

Contact us directly at 626-796-6622 or

clientservices@firstwilshire.com.

This report is for informational purposes and is not a solicitation or a recommendation of any issuer or its securities. Additionally, this report should not be deemed as a research report and no investment decisions about any particular security or issuer should be made exclusively based on the information and content contained in this publication. First Wilshire Securities Management, Inc. (“First Wilshire” or “FWSM”) is an independent registered investment adviser with the Securities and Exchange Commission. First Wilshire claims compliance with the Global Investment Performance Standards (GIPS©). FWSM’s compliance with the GIPS© standards has been verified for the period from 12/31/1996 to 3/31/2017 by Ashland Partners & Company LLP and from 4/1/2017 to 12/31/2020 by ACA Performance Services, LLC. In addition, a performance examination was conducted on the Separately Managed Accounts Composite beginning 12/31/1986. A copy of the verification report is available upon request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Separately Managed Accounts Composite includes all separately managed accounts that FWSM has an investment management agreement with. This composite typically, but not exclusively, invests in small capitalization, U.S.-listed stocks. The composite was created in December 1986. The benchmark is the Russell 2000® Index, which is a market cap-weighted index and measures the performance of the 2000 smallest companies in the Russell 3000 Index. The firm maintains a complete list and description of composites and a compliant presentation, which are available upon request (Please contact Client Services at 626-796-6622). The U.S. Dollar is the currency used to express performance. Past performances of stock markets, as well as those of FWSM’s client pofoolios or any individual securities, may not be indicative of future results. Investments, including First Wilshire separately managed accounts, offer the possibility of loss. In general, smaller capitalization equities are considered riskier than larger capitalization equities due to, among other factors, lower trading volume and less financial resources. In fact, past performance should be only one of many considerations in selecting an investment manager. Please do not make investment decisions based solely on past performance. ADV II available on request and should be reviewed prior to investing.