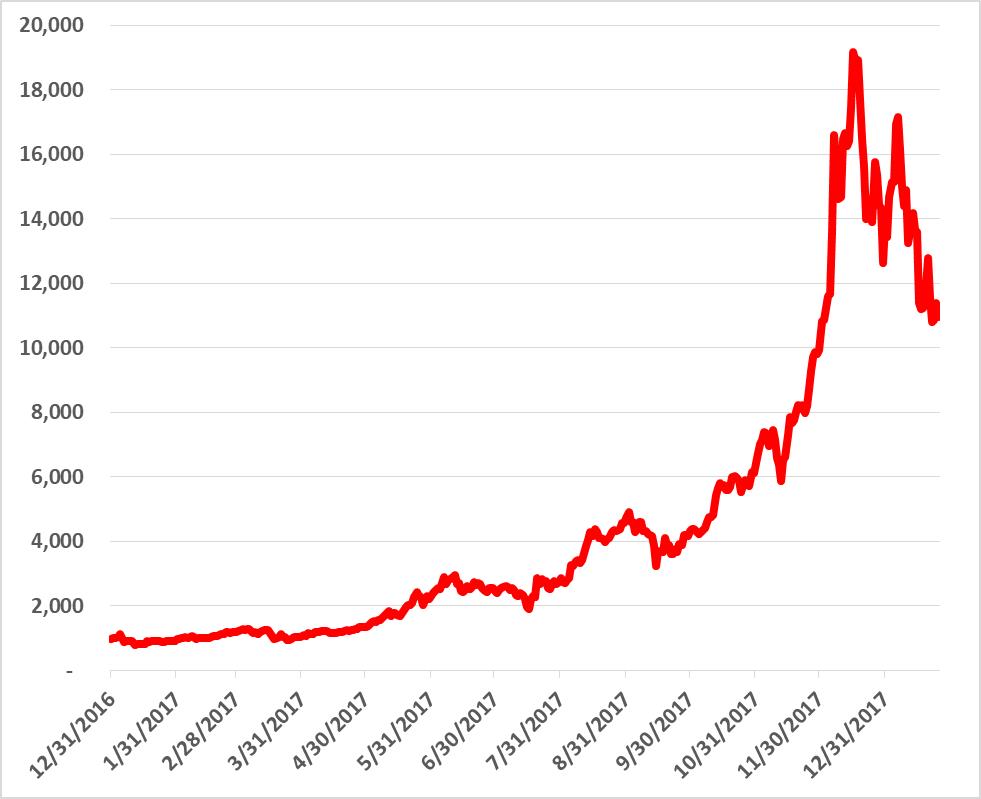

We have been asked several times what we think of bitcoin and crypto-currencies. Generally we just say we don’t think much about it and forward a few good articles we have tucked away. We have no idea where it should trade and believe it has about equal odds of dropping to 5,000 as it has of going up to 50,000 (it currently trades at 11,145 or over 1,000% above its 2016 closing price).

Block chain technology is not important to our portfolio companies, though the technology should continue to spread into and benefit other industries. We are pleased to have a couple companies who produce technology used by the crypto-currency industry. Often the real money is in selling shovels and pans to the gold miners rather than in actually mining for gold.

Buying Bitcoin now as an investment is about as stupid as anything we have seen. Not because some people haven’t made money on it or won’t make money in the future, but because people pile in simply because it has already gone up, the definition of bubble-like behavior and clearly not a strong enough premise to allocate hard-earned savings. Just because something has gone up, or the roll of the dice came up 7 a few times in a row, is not a reason to invest/gamble. To be fair, people who bought before December of last year have profits, some have very high profits, and they would laugh at our thoughts on Bitcoin, for now. And by the way, we would have said the same thing when it was valued at thousands of dollars lower. The question here is whether a positive outcome on a wild bet makes the original bet less reckless. We believe it remains reckless regardless of the outcome. Talk amongst yourselves.

Setting aside the investment debate, while crypto-currencies like Bitcoin may in theory hold promise as an alternative currency, the extreme volatility and average per transaction cost of $30 (Economist, January 13, 2018) renders it nearly useless as a currency at this point. How about a $35 cup of coffee? Imagine trying to price your goods and services or paying your workers in Bitcoin. To date, crypto-currencies are used as a temporary and volatile store of value as traditional currencies are used to buy crypto-currencies and later transferred back into traditional currencies. Our disparaging remarks about Bitcoin are related to piling in to a fast rising investment fad, not the concept of a crypto-currency. The case for an alternative currency is compelling and if transaction costs can be greatly reduced and the exchange rate stabilizes, it could work. Meanwhile, what we see today is what the early stages of building such a currency should look like.

One argument in support of Bitcoin’s value is that there are only 21 million units available to be mined, which means a central government cannot just print more on a whim. However, as food for thought on this issue, since there are many crypto-currencies already created and many more launching, the number of units is potentially infinite, therefore diminishing the static units argument.

Bitcoin Price from 2016 to 2017.

As with any mania, there are plenty of ridiculous stories coming out of the current crypto craze and these cases are really the fun part of addressing this. Our favorite examples in the latest quarter included the Long Island Iced Tea Company that changed its name to Long Blockchain Corp* causing the stock to go up nearly 300%. Their business plan is now to invest in blockchain related companies, but to date they appear to have no operations or interests in anything blockchain. Another example was a company formerly named CROE that was a start-up company in women’s fitness apparel, specifically sports bras. Changing their name to Crypto Corp* and announcing a change in their business model to “advising regarding, investing in, trading and developing proprietary source code for the management of digital assets. Our core services include consulting and advice to companies regarding investment and. . .” Despite having no recordable activity in crypto-currencies or blockchain technology, the company’s stock soared from approximately $10 per share to over $640 per share, valuing the company at over $12 billion. This is for a company with under $500 thousand of revenues in the most recent quarter, $1.5 million losses and no stated proprietary intellectual technology. However, they did claim $900 thousand in cryptocurrency assets which means they were trading at over 13 thousand times the value of their crypto currency, an asset in itself that is likely overvalued.

Kids are speculating in crypto currencies and setting up computers to “mine” for Bitcoin so perhaps the last sucker in this bubble will be found on the playground. Or more likely, their parents.

* First Wilshire is neither long or short any company or crypto-currency mentioned above and is not making a recommendation one way or the other on them.