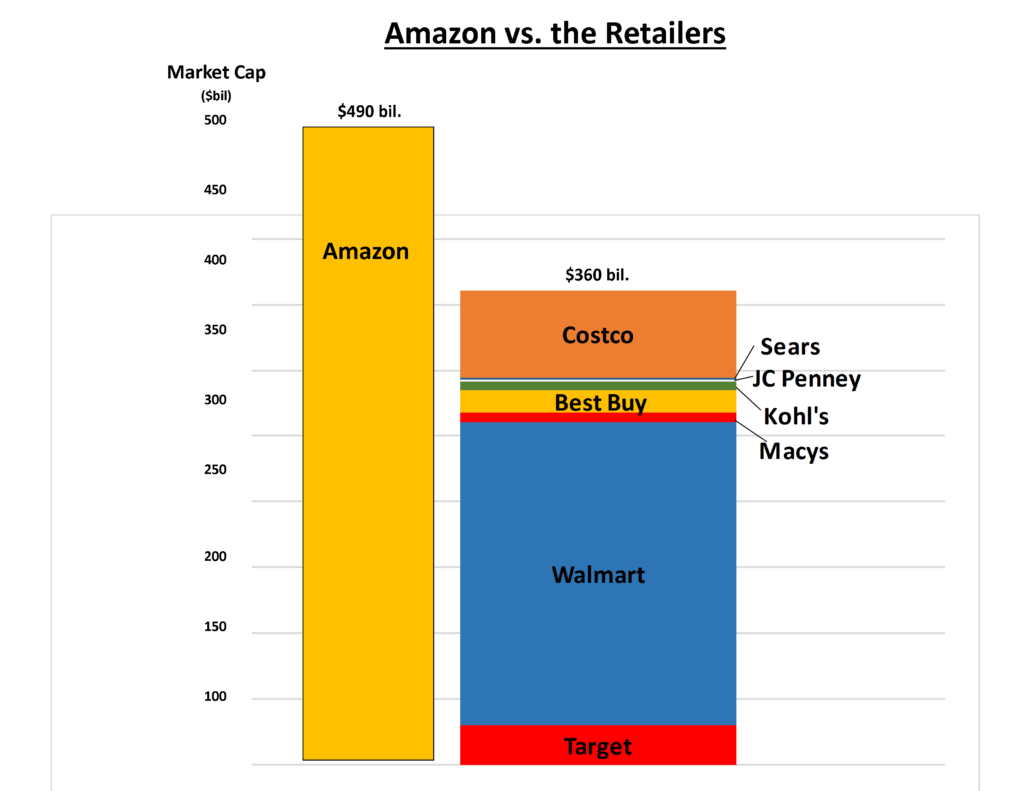

Disruption, confusion and severe stock price drops always offers the opportunity to uncover mispriced stocks. This led us to screen through all the U.S. retail companies, visit select companies and stores, while debating the future of retail. The disruption of retail begins with a look at Amazon. So far in 2017, Amazon’s stock market value has moved up by 34% or $123 billion. Meanwhile, the combined value of all the rest of retail stocks declined by $18 billion and have an average short interest ratio of over 11% (the short interest ratio is basically the % of shares betting the stock price will fall). To further illustrate the importance of Amazon, consider the chart below.

The market value of Amazon is now 36% higher than the combined total of all of these major retailers. Approximately half of U.S. households are Amazon prime subscribers in 2016 (by our quick estimate, $6.4 billion Amazon retail subscription services divided by $99 prime subscription price = 64.6 mil or 51% of US households).

While there are some winners in retail stocks outside of Amazon, most were sold off heavily, as investors worry about the future of the industry, the power of brands and the methods of distribution and sales. Investors don’t see a future for most retailers in this new Amazon world.

Given the blood in the streets, we decided to look through the carnage left in Amazon’s wake. We performed a screen of all retail related stocks, selecting a few for our team to follow up on. Is this retail downturn overly played out? Are investors too pessimistic? These are the questions we are considering.