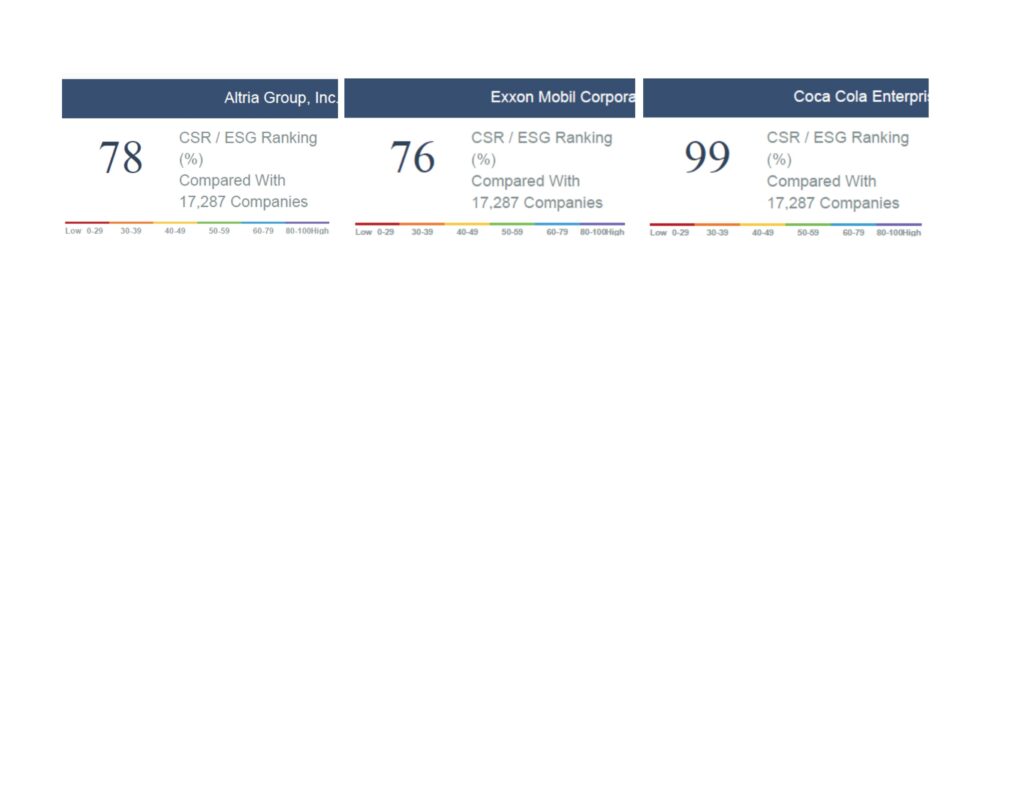

How Socially Conscious are ESG Funds?

The concept of socially conscious investing, known as ESG (for Environmental, Social, and Governance investment criteria) has been around a long time but has picked up steam in recent years. One of your portfolio managers did his senior project in college under the guidance of one of the early professors in the ESG area, who […]

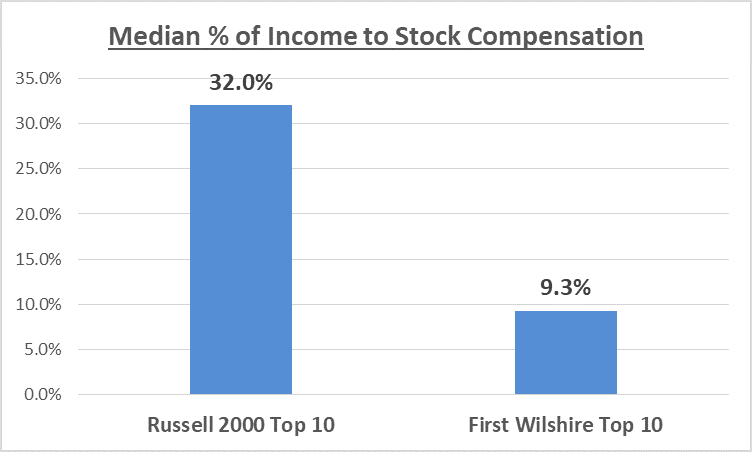

High Valuations and High Compensation in the Russell 2000

The top 10 Russell 2000 companies had a combined market capitalization of $66.1 billion, produce pre-stock compensation after tax profit of $815.8 million of which they paid out $357.5 mil in stock compensation (44%). The median stock compensation of the top 10 was 32.0% and trade at a price-to-earnings multiple of 144x. This is a […]

2019 Stock Market Forecast: First Wilshire’s Scott Hood talks to Investor’s Business Daily

First Wilshire CEO Scott Hood is featured in Investor’s Business Daily’s ‘Stock Market Forecast for 2019’. “Small-cap stocks can be an important fuel for the overall market. But in late 2018, they led Wall Street’s slump. Will they continue to be a drag?” The article states that 2019 could shape up to be a stock […]

First Wilshire’s Bill Caton speaks with The Wall Street Transcript

Bill Caton, CFA, Research Analyst and Senior Trader at First Wilshire spoke with The Wall Street Transcript’s Ed Silverstein regarding his disciplined, value-oriented approach to uncovering small cap gems. Read more of the interview at The Wall Street Transcript

First Wilshire’s CEO Scott Hood Interviewed by Bloomberg

Scott Hood, CEO and Portfolio Manager at First Wilshire appeared on Bloomberg Daybreak Australia where he discussed top-line issues – like global trade tensions and interest rates that could impact and potentially boost small cap performance in 2019. He also touched upon the market for leveraged cyclical stocks, noting that it could be time for […]

First Wilshire’s Howard Lu provides insight on small-cap stocks to Barron’s

First Wilshire’s Howard Lu, portfolio manager and director of research, said in an interview with Barron’s that “investing in small-caps is one way to bet on the U.S. economy versus the rest of the world.” “To the extent that the domestic economy is performing better than the international economy, whether it’s in reality or investors’ […]

First Wilshire’s CEO Scott Hood Speaks with Barron’s

First Wilshire CEO and Portfolio Manager Scott Hood was featured in Barron’s, where he discussed valuations of major internet stocks in the Chinese equities market off the back of his recent trip to the country. Article Excerpt When Tencent shares will rise again is harder to predict. For one thing, valuation isn’t particularly low. “The […]

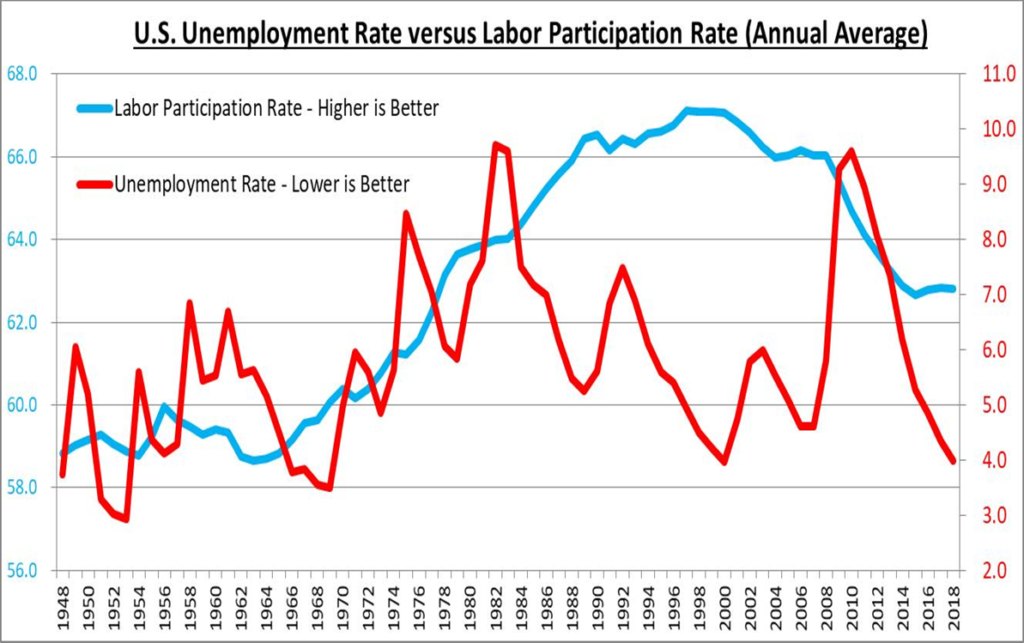

Unemployment Rate at Rare Level

Excerpt from our newsletter: A headline worth pointing out from the 2nd quarter was the official unemployment rate hitting 3.8%, the lowest level in 18 years. It is interesting to note that the last time unemployment hit 3.8% was in April 2000 and lasted only one month. One would have to go all the way […]

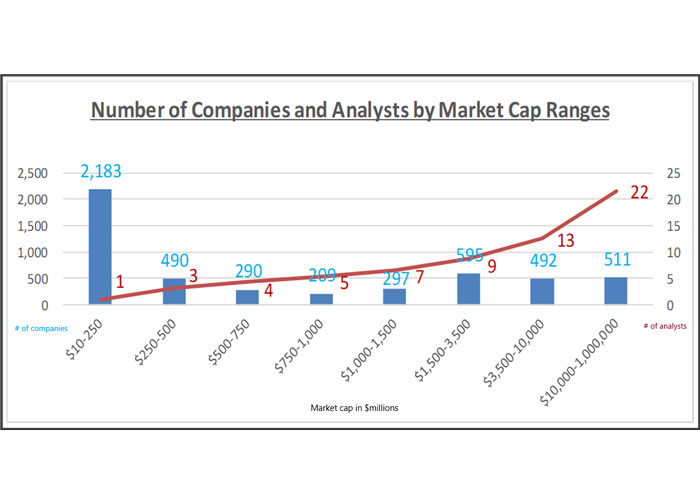

The Active Advantage

We operate in an area of the market much better suited to active management. There are far more companies to sort through and much less information is readily available. We are true active investors performing in-depth research from the bottom up. Each position is owned because we believe it offers superior upside potential, often coupled […]

First Wilshire Hosts Client Meeting

First Wilshire recently had the privilege of hosting a client appreciation brunch for our Los Angeles area clients at a historical Pasadena venue. The portfolio managers and analysts discussed the reasons small cap value stocks have historically outperformed growth and large cap stocks, First Wilshire’s hands-on research process, and the outlook going forward. We enjoyed this […]