4th Quarter 2022 Newsletter

Dear Clients, For many investors, 2022 was a year to forget. The Russell 2000 was down 20.5%, the S&P 500 was down 18.1% and the NASDAQ Composite was down 32.5% for the year. These are their worst annual returns since 2008. The most popular cryptocurrency, Bitcoin, was down 64.3%. Even bonds did not provide a […]

1st Quarter Newsletter

Dear Clients, The stock market was highly volatile in the first quarter of 2022. The rising interest rates and Russia’s invasion of Ukraine were the two main drivers behind such volatility. At one point, the S&P 500 and the Russell 2000 were down over 10% since the beginning of the year, while the NASDAQ was […]

4th Quarter 2021 Newsletter

We are happy to report another positive performance for the 4th quarter. This marked the 7th consecutive positive quarterly return for our Separately Managed Accounts Composite (individual account performance may vary). The composite return for the year 2021 was 31.7%, outpacing all major indices. We are proud to have stuck to value investing amidst a […]

Interest Rates Increase 3x

It’s truly ironic that the stock market is very likely higher now than it would’ve been if no pandemic had taken place in 2020. The economy has been boosted by continuing vaccination efforts, aggressive monetary policies by the Federal Reserve, and the strong fiscal response by the federal government, but still, this is an outcome […]

Tracking Global Reopening from Airplane Boneyards

Visit to Mojave Air and Space Port and Victorville Airport in the high desert of California. During Covid-19, and apparently with limited sources of entertainment, we visited the two largest “boneyard” airports in California. To see billions of dollars’ worth of beautiful planes dressed up in their carrier’s design sitting idle in a desert is […]

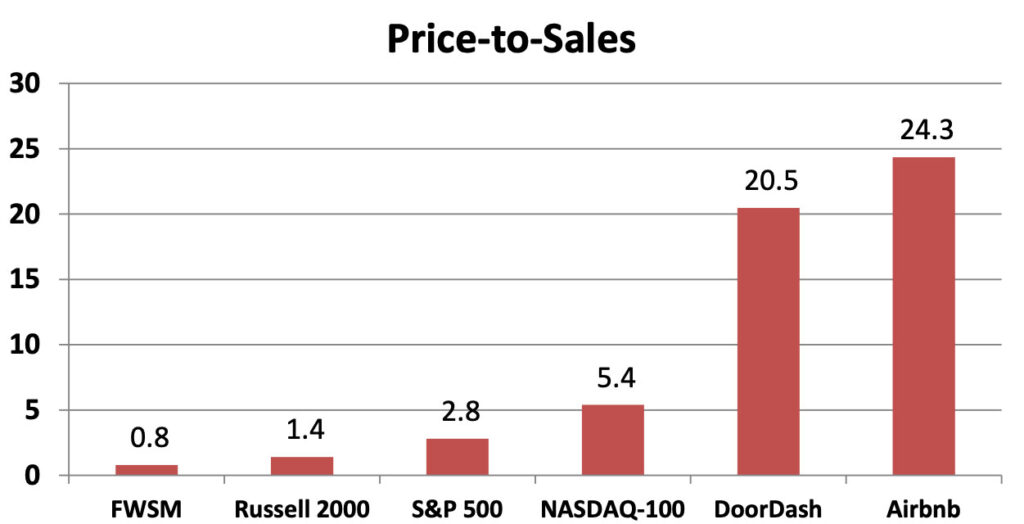

Pie in the Sky Stock Market Valuations

The more investors are obsessed with pie in the sky, the more they ignore gems at hand. We understood this 20 years ago as we bought into very-low-P/E stocks during the dot-com bubble, and eventually the discipline and patience paid off handsomely. We believe the same strategy can be applied in this market cycle. This […]

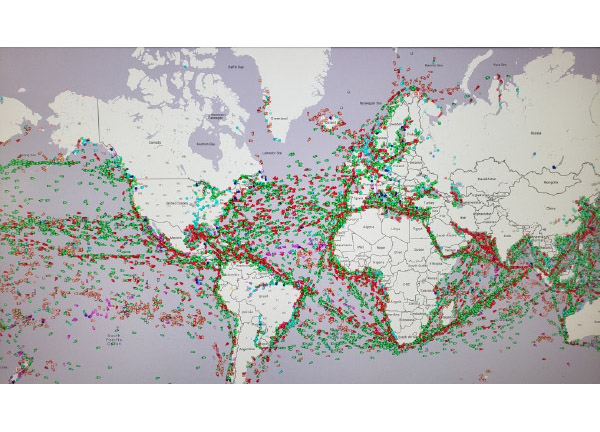

Tracking Global Maritime Traffic

This is a global image of all maritime traffic on the first morning of the first business day of 2021 (tankers are colored red, cargo are green, fishing is orange). Ships transmit a GPS signal that allows for real time data, a useful tool. Early in 2020, estimates for the shipping industry were dire. With […]

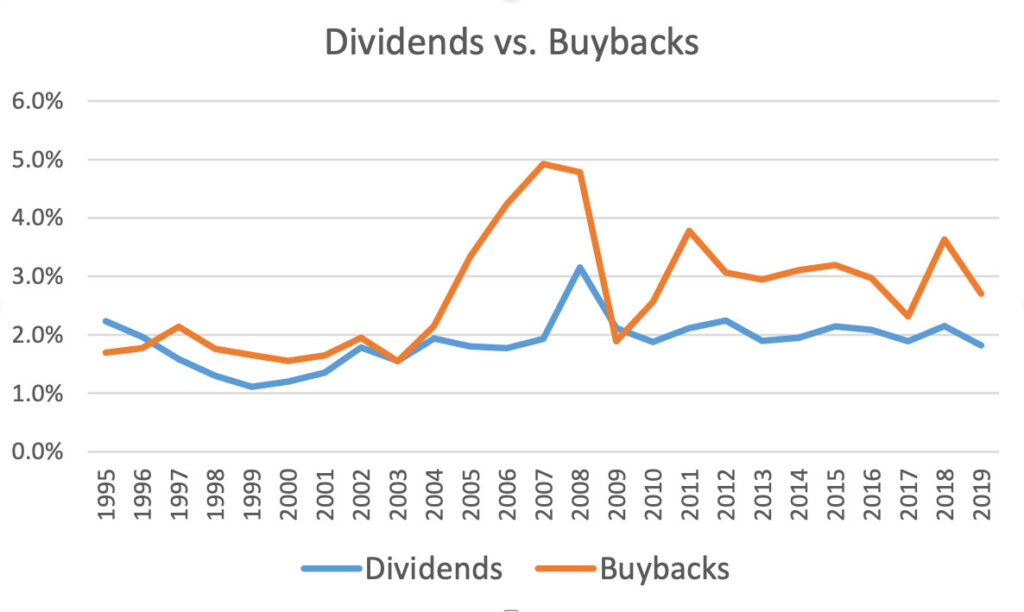

Stock Buybacks Continue to Exceed Dividends

This is a chart of dividends vs. buybacks for S&P 500 in the last 25 years. We picked S&P 500 as the point of discussion because it’s more representative of the general U.S. stock market and has reliable data. For illustration purposes, we calculated “buyback yield” by dividing buyback per share by the stock price, […]

Coronavirus Update

Coronavirus Disease (aka “SARS-CoV-2”, “COVID-19”) How is First Wilshire Prepared as an Organization? The Coronavirus disease (“COVID-19”) is a major global challenge that has resulted in significant stock market losses and, more importantly, concerns about the health of our families, friends and neighbors. There are many things out of our control. However, there are many […]

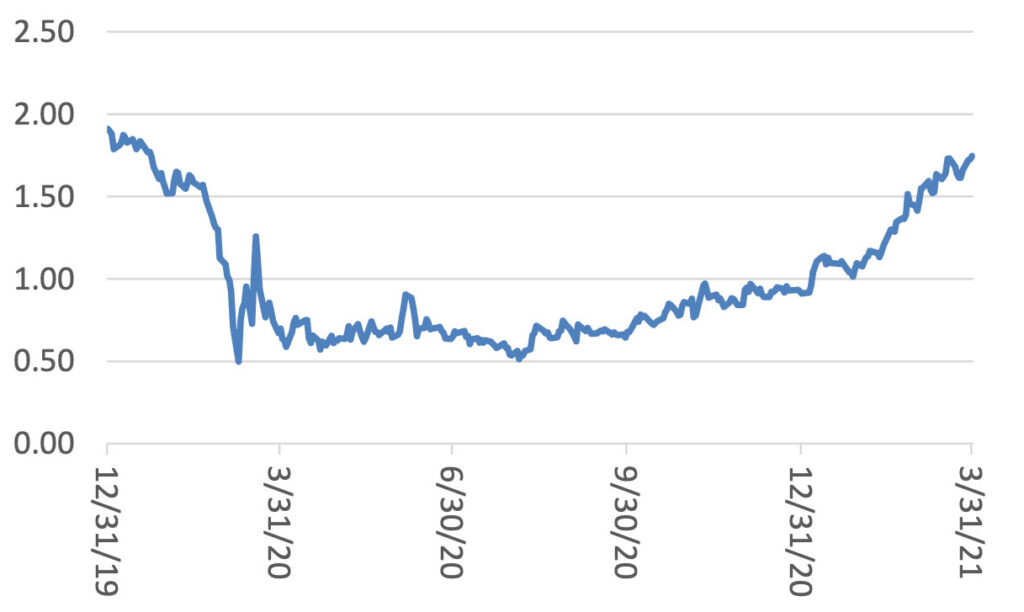

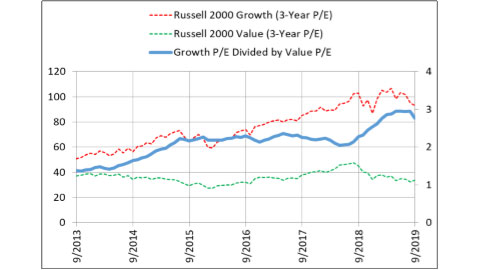

Small Cap Growth P/Es Relative to Value

Despite all the economic uncertainties, dizzying headlines, and volatilities, the stock market has held up surprisingly well. The overall market, as measured by S&P 500, is 7.1% above its previous record high (Sept, 2018). In a strong market, value investors tend to see fewer opportunities due to higher valuations. However, we haven’t observed a dwindling […]